Central Limit Order Books (CLOBs) vs AMMs: A Comprehensive Guide for DeFi Trading

Thomas Cosialls

Thomas CosiallsImagine walking into two different markets. In the first, you can only buy apples at whatever price a vending machine calculates based on how many apples are left inside. In the second, you can see all the farmers listing their apples at different prices, choose the best deal, or even post your own price and wait for someone to accept it. This fundamental difference captures the essence of AMMs versus CLOBs in decentralized finance.

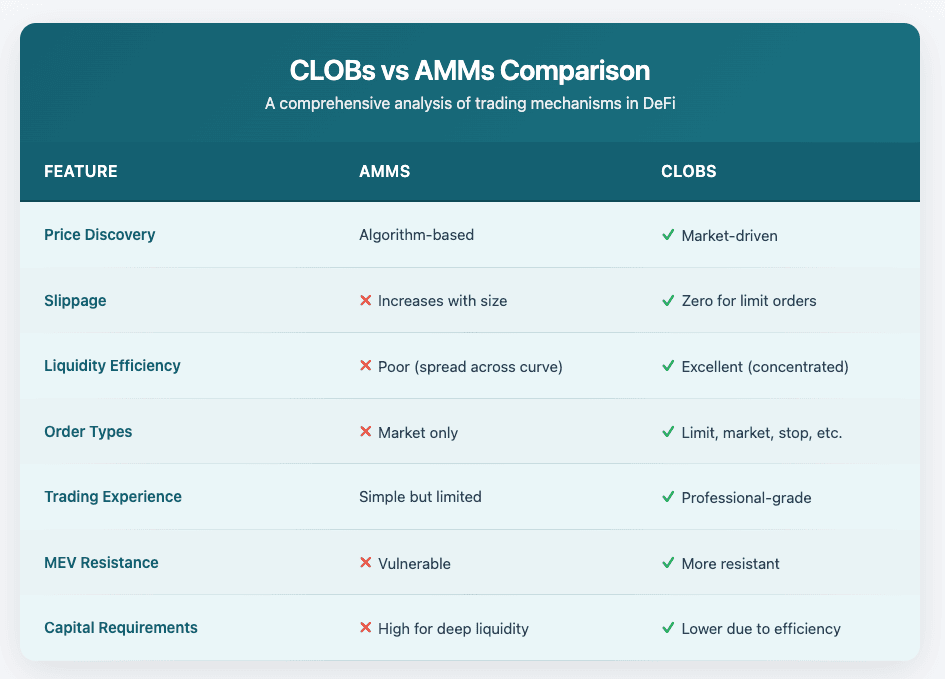

Central Limit Order Books (CLOBs) represent a fundamental evolution in decentralized exchange (DEX) architecture, offering traders the precision and efficiency of traditional financial markets within the DeFi ecosystem. While Automated Market Makers (AMMs) pioneered decentralized trading, CLOBs address critical limitations by enabling exact price matching, reducing slippage, and concentrating liquidity where it matters most.

Understanding Automated Market Makers (AMMs)

What Are AMMs?

To appreciate why CLOBs matter, we first need to understand what AMMs brought to the table and where they fall short. Think of an AMM as a brilliant solution to a complex problem: how do you enable trading when you can't have a traditional order book on a blockchain that processes transactions slowly and expensively?

Automated Market Makers revolutionized DeFi by enabling permissionless token swaps without traditional order books. AMMs use mathematical formulas—most commonly the constant product formula (x * y = k)—to determine asset prices based on the ratio of tokens in liquidity pools.

Key characteristics of AMMs include:

- Liquidity pools containing pairs of tokens

- Algorithmic price determination

- Passive liquidity provision

- Immediate trade execution

- No order matching required

How AMMs Function

When you trade on an AMM-based DEX like Uniswap or SushiSwap, you're not trading with another person—you're trading against a smart contract-controlled liquidity pool. The AMM algorithm automatically adjusts prices based on the pool's token balance after each trade.

For example, in a ETH/USDC pool:

1- Traders deposit equal values of both tokens

2- The AMM uses x * y = k to maintain balance

3- As traders buy ETH, its price increases relative to USDC

4- The pool rebalances automatically after each trade

Critical Limitations of AMM-Based Trading

1. Price Slippage on Large Orders

AMMs suffer from significant slippage, especially for large trades. Since prices are determined by pool ratios, substantial orders can dramatically shift the balance, resulting in worse execution prices than expected. A $1 million trade might move the price by 5-10% or more, depending on pool depth.

2. Inefficient Liquidity Distribution

AMMs spread liquidity across the entire price curve from zero to infinity, even though most trading occurs within narrow price ranges. This means:

- Capital efficiency is poor

- Deeper liquidity is needed to achieve tight spreads

- Liquidity providers earn less per dollar deployed

3. Impermanent Loss for Liquidity Providers

When token prices diverge from their initial ratio, liquidity providers suffer impermanent loss—they would have been better off simply holding the tokens. This risk discourages liquidity provision and increases the cost of capital.

4. Limited Order Types

AMMs only support market orders (swaps). Traders cannot:

- Set limit orders to buy/sell at specific prices

- Use stop-loss orders for risk management

- Implement advanced trading strategies

- Wait for better prices without active monitoring

5. MEV (Maximum Extractable Value) Vulnerability

AMM trades are highly susceptible to sandwich attacks and front-running, where bots exploit pending transactions to extract value from traders.

Central Limit Order Books (CLOBs): The Professional Trading Solution

What Are CLOBs?

A Central Limit Order Book is a trading mechanism that organizes all buy and sell orders by price level, matching them when prices converge. Think of it as a digital marketplace where traders post exactly what they want to buy or sell at specific prices.

Core components of a CLOB:

- Bid side: All buy orders ranked from highest to lowest price

- Ask side: All sell orders ranked from lowest to highest price

- Order matching engine: Automatically executes trades when bid and ask prices meet

- Order types: Limit orders, market orders, stop orders, and more

How CLOBs Transform DeFi Trading

CLOBs bring institutional-grade trading capabilities to decentralized exchanges:

- Precise Price Discovery: Orders cluster around fair market value, creating accurate price signals

- Zero Slippage Limit Orders: Trade at exactly your desired price or not at all

- Concentrated Liquidity: Capital focuses where trading actually happens

- Professional Trading Tools: Advanced order types enable sophisticated strategies

- Better Spreads: Competition between market makers tightens bid-ask spreads

Technical Architecture: Why CLOBs Are Now Possible in DeFi

The Scalability Challenge

Traditional blockchains like Ethereum's mainnet cannot support CLOBs due to:

- High gas costs for frequent order updates

- Slow block times preventing real-time matching

- Limited throughput constraining order volume

Modern Solutions Enabling On-Chain CLOBs

High-Performance Chains and Layer 2s:

- Process thousands of orders per second

- Sub-second finality for real-time execution

- Minimal transaction costs

Advanced Data Availability Layers:

- Ensure order book integrity

- Enable parallel processing

- Maintain decentralization

Optimized Virtual Machines:

- Purpose-built for high-frequency operations

- Efficient state management

- Native order matching capabilities

Real-World CLOB Implementations in DeFi

Hyperliquid: The Breakout Success

Hyperliquid has emerged as the leading CLOB-based DEX, processing over $100 billion in volume with features including:

- Native limit and market orders

- Advanced order types (stop-loss, take-profit, trailing stop)

- Up to 50x leverage for perpetual futures

- Cross-margin capabilities

- API access for algorithmic trading

Performance metrics:

- 20,000+ orders per second capacity

- <0.2 second order finality

- $0.00025 average transaction cost

- 99.95% uptime since launch

GTE (MegaETH testnet)

GTE is the world’s fastest decentralized exchange, covering the entire lifecycle of a token – from its initial launch to sophisticated perpetuals trading – all on a single, high-performance platform. Unlike traditional approaches that force users to navigate separate launchpads (like PumpFun), DEXs (like Raydium), and CLOBs (like Binance or Hyperliquid) for different stages of an asset’s journey, GTE unifies these critical market structures.

Comparative Analysis: CLOBs vs AMMs

Conclusion

Central Limit Order Books represent the natural evolution of DeFi trading infrastructure. By addressing the fundamental limitations of AMMs—slippage, capital inefficiency, and limited functionality—CLOBs enable decentralized exchanges to compete directly with centralized counterparts.

As blockchain scalability improves and more sophisticated trading infrastructure emerges, CLOBs will likely become the dominant trading mechanism for professional DeFi participants. The success of platforms like Hyperliquid demonstrates clear market demand for advanced trading capabilities in a decentralized environment.

For blockchain developers and DeFi projects, understanding and implementing CLOB technology is becoming increasingly critical to remain competitive in the evolving landscape of decentralized finance.

References and Further Reading

1. "Central Limit Order Book Design in Decentralized Exchanges" - DeFi Research Collective, 2024

2. Hyperliquid Documentation and Performance Metrics - docs.hyperliquid.xyz

3. "The Evolution of DEX Architecture" - Ethereum Foundation Research, 2024

4. Fuel Network Technical Specifications - fuel.network/specs

5. "Comparing AMM and CLOB Efficiency" - Journal of Decentralized Finance, 2024